Understanding Equity Financing vs. Debt Financing

The work just isn’t complete, so the $1 million is taken into account a legal responsibility. It’s a nearly $22 billion company with no debt, which is inefficient. The drawback for Google is that their cash move and revenue are so robust that they will finance the business with retained earnings.

Calculating the D/E Ratio in Excel

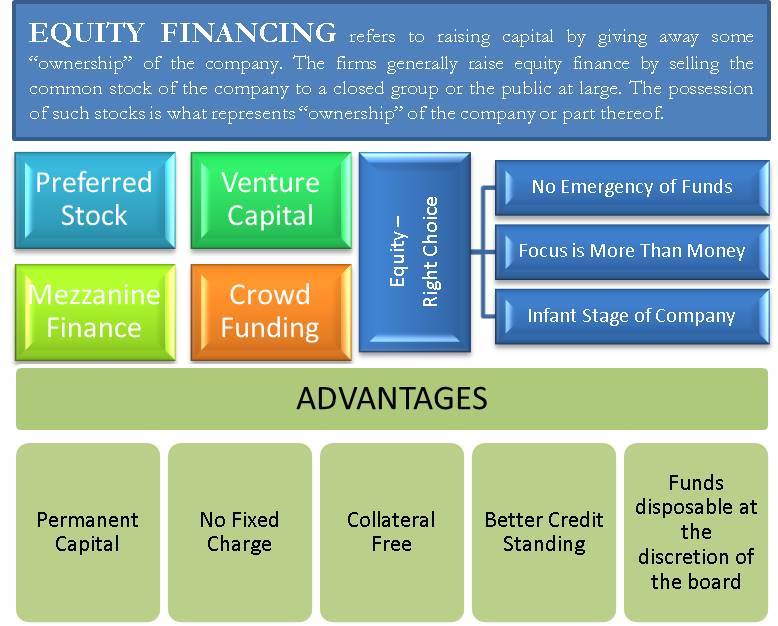

The amount of cash that is required to obtain capital from different sources, known as price of capital, is crucial in figuring out a company’s optimum capital construction. Cost of capital is expressed either as a proportion or as a dollar quantity Bookkeeping, relying on the context. Equity financing refers to funds generated by the sale of inventory. The main benefit of fairness financing is that funds needn’t be repaid. However, fairness financing isn’t the “no-strings-connected” solution it may seem.

Which of the next statements just isn’t true of venture capitalists? (A) They need the entrepreneur and the management to run the company https://cryptolisting.org/. (C) They are excited about attempting to handle corporations themselves.

What is an example of debt financing?

Disadvantages of Equity Cost: Equity investors expect to receive a return on their money. The amount of money paid to the partners could be higher than the interest rates on debt financing. Loss of Control: The owner has to give up some control of his company when he takes on additional investors.

Repayment of Principal and Interest

Equity financing locations no additional monetary burden on the company, nonetheless, the downside is sort of large. What if your organization hits onerous times or the financial system, once again, experiences a meltdown? What if your small bookkeeping business does not develop as quick or as well as you anticipated? Debt is an expense and you need to pay bills on an everyday schedule. The draw back to debt financing is very real to anyone who has debt.

Unlike inventory options, a company issues warrants somewhat than an change; warrants additionally final substantially longer than options. To safe venture capital funding, you’ll must exchange equity for that capital, and cede control of somewhat bit more of your company. If you don’t need to slice up your fairness any further, particularly if you’ve already diluted your management greater than you’re feeling comfortable, taking on a venture capital loan can be a superb concept.

When going public, particular detailed information that must be presented includes (A) a 20-year plan. When going public with public choices a bonus may be (A) dimension of the company’s capital quantity. The most common source of debt financing is (A) commerce credit score. Sources of debt financing embody trade credit, accounts receivables, factoring, and finance companies.

Mezzanine financing combines debt and fairness financing, starting out as debt and allowing the lender to convert to fairness if the mortgage is not paid on time or in full. Financing is the process of offering funds for business activities, making purchases, or investing. Financial institutions similar to banks are in the enterprise of providing capital to businesses, customers, and investors to assist them achieve their objectives.

Should a Company Issue Debt or Equity?

This permits businesses to determine which ranges of debt and equity financing are most price-effective. Assuming the tax price is 30 %, the above mortgage would have an after-tax cost of capital of four.2%.

What are the sources of debt financing?

Besides determining the value of a company, equity is important to businesses because it can be used to finance expansion. Funding business expansion by selling shares of stock to investors is “equity financing.” When a company sells stock, it sells equity to investors for cash that it can use to fund growth.

- Make positive you’re working with a lender who practices transparency and will provide you with sincere numbers.

- Debt financing covers plenty of ground, however there are other ways to fund your corporation.

- The revised edition of their traditional Financial Intelligence will be revealed in February.

- Understanding the fundamentals of how these products are underwritten, secured, and assessed will clarify who ends up qualifying for either.

- Once you repay the amount you borrowed plus curiosity, you have no further obligations to the lender, who has no claim on the future earnings of your corporation.

- Because of this, you’re more likely to be accredited without providing separate collateral than with different forms of debt financing.

Coupon is an attachment with a bearer bond that has to be surrendered to collect interest fee. A zero coupon bond means low cost bond with no coupon funds. Ratio analysis refers to a method of analyzing an organization’s liquidity, operational effectivity, and profitability by comparing line items on its monetary statements. Assume that the company has purchased $500,000 of inventory and materials to finish the job that has increased total property and shareholder fairness. If these amounts are included within the D/E calculation, the numerator shall be increased by $1 million and the denominator by $500,000, which is able to increase the ratio.

How Should a Company Be Raising Capital?

What is Startup debt financing?

The formula for risk premium, sometimes referred to as default risk premium, is the return on an investment minus the return that would be earned on a risk free investment. The risk premium is the amount that an investor would like to earn for the risk involved with a particular investment.

Given that the century ended on the peak of the dot-com bubble, however, this arbitrary window is probably not perfect. James Woodruff has been a administration marketing consultant to more than 1,000 small businesses. As a senior management consultant and owner https://cryptolisting.org/blog/what-is-the-formula-for-depreciation, he used his technical experience to conduct an evaluation of an organization’s operational, financial and enterprise management issues. James has been writing enterprise and finance related subjects for work.chron, bizfluent.com, smallbusiness.chron.com and e-commerce web sites since 2007.

But with collateral built into the mortgage, the risk is way lower for the lender, so you don’t essentially want to offer them years of stellar performance. These loans are sometimes extra accessible for early-stage startups, and businesses with less operational history in general, as a result of they’re self-secured. This signifies that the acquisition that the mortgage is financing itself is the loan’s collateral. For instance, when you default on an equipment mortgage for a 3D printer, the gear lender will seize the printer and liquidate it to recoup their losses. In short, whoever holds a warrant has the right to buy inventory at a set exercise worth, as indicated by the strike worth on the warrant, up to a sure point of expiration as noted.

For instance, assume you sell a majority of your organization’s excellent inventory to lift cash, and buyers disapprove of the company’s progress. In this case, because of your choices and your decreased possession proportion, they might have the power to vote you out of a management position and herald new management. While the money is a definite advantage of new equity, the partners that you’re going to work with even have a vested interest in seeing your small business succeed. If these companions have a good deal of experience, connections and influence, this might make all the difference between a struggling or thriving enterprise.

FUNDING/FINANCING

He graduated from Georgia Tech with a Bachelor of Mechanical Engineering and acquired an MBA from Columbia University. Borrowing money to finance the operations and development of a enterprise could be the right determination beneath the right circumstances. The owner would not have to give up management of his business, however an excessive amount of debt can inhibit the growth of the company. Companies report capital on the stability sheet and seek to optimize their whole cost of capital.

Raising a VC spherical usually takes between six and 9 months of coffee meetings, pitches, and telephone calls. Lighter Capital, where I work, typically funds firms in one month. Calculating the cost of debt includes finding the average interest paid on all of a company’s money owed. The key difference between the cost of debt and the after-tax value of debt is the fact that interest expense is tax-deductible.

Invoice Financing

What is the difference between risk premium and market risk premium?

It starts with the fact that equity is riskier than debt. Because a company typically has no legal obligation to pay dividends to common shareholders, those shareholders want a certain rate of return. Debt is much less risky for the investor because the firm is legally obligated to pay it.

Other financial accounts, such as unearned income, shall be categorised as debt and may distort the D/E ratio. Imagine a company with a pay as you go contract to assemble a constructing for $1 million.

But I predict that as Google matures and development slows, debt will turn into an important source of funding. In distinction, unsystematic threat is the amount of risk associated with one specific investment and is not associated to the market. As an investor diversifies their investment portfolio, the quantity What is an Allowance For Doubtful Accounts? of danger approaches that of the market. Systematic and unsystematic danger and their relation to returns is where the various clichés about diversifying your investment portfolio is derived. Lenders will still have a look at your credit rating and enterprise financials.